Cash Reserves and Short-Term Borrowing under Liquidity Constraints

Image credit: Luis Navarro

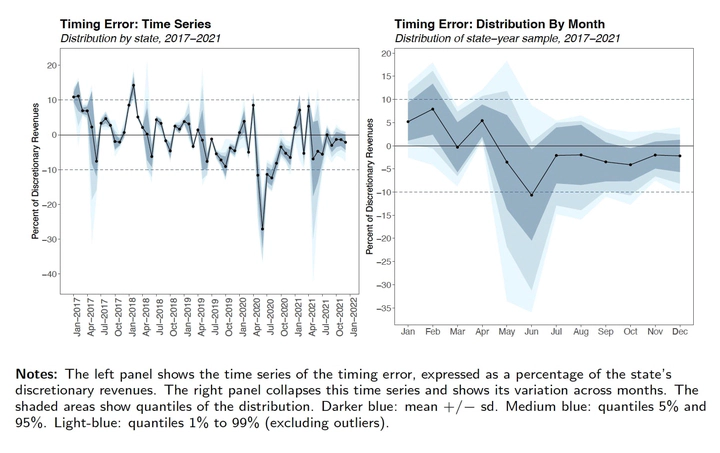

Image credit: Luis NavarroGovernments ensure uninterrupted service delivery with timely payments on operating expenses by maintaining sufficient cash reserves and/or resorting to short-term borrowing. A theoretical model of cash-flow management shows that the precautionary role of cash reserves shapes the liquidity constraints experienced by low-capitalized governments. I test this theory by looking at state governments from Mexico that face stringent liquidity constraints. To provide causal estimates, I instrument cash reserves with plausibly exogenous variation in the deviation from anticipated monthly distributions of one of the largest federal grants, which are not correlated with annual financial conditions but lead to temporary changes in states’ potential cash holdings. Empirical results find a positive effect of cash reserves on short-term borrowing, with an implied elasticity between 0.6 and 1.3, where the magnitude of this effect is determined by the stringency of the liquidity constraints faced by state governments, which for this analysis are explored in terms of levels of cash-reserves, credit quality, and stage of the fiscal year. These findings are consistent with theoretical expectations of cash-flow management under liquidity constraints and provide evidence that complements the previous empirical research studying American local governments with softer credit constraints.