Liquidity and Volatility in the Municipal Bond Market: Evidence from the Municipal Liquidity Facility and other early interventions

Image credit: Luis Navarro

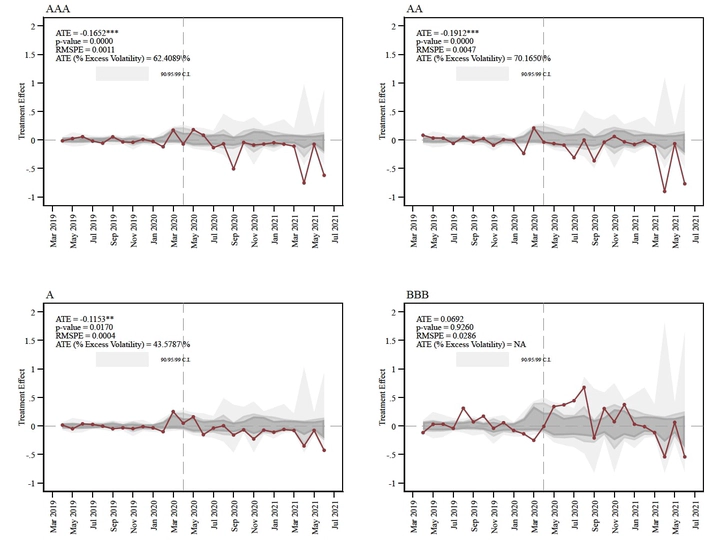

Image credit: Luis NavarroAt the onset of the pandemic, the federal government stepped in with fiscal and monetary policy actions to assist distressed municipalities. In particular, the Municipal Liquidity Facility (MLF) was established to create a market maker of last resort. In this paper, we examine the extent to which the provision of federal aid to states and the implementation of the MLF was successful in promoting proper market functioning by looking at the plausibly causal effect of these policies on medium-term municipal market volatility. Leveraging a combination of financial instruments outside of the Municipal Bond market, and past observations of state bond yields, we use a synthetic control approach to compute counterfactual volatility series, had the federal government not intervened. Aligning with previous literature, our results suggest that, for A-rated bonds and other instruments of higher credit quality, federal support (both direct fiscal stimulus and liquidity backstops), lead to volatility reductions in the municipal market between 43% - 70% of the incremental volatility experienced by state issuers at the peak of the 2020 financial turmoil. We further examine variation on these effects driven by the magnitude of direct fiscal stimulus received by state governments, finding some suggestive evidence on the relevance of the MLF restoring confidence into markets, even when it observed a low take-up rate among states. Our paper highlights the role that government intervention has on financial markets’ perception and the process of price formation in the secondary market, as well as the role of the Federal Reserve as a lender of last resort during episodes of distress.